Income REITs vs. Bonds: A Data-Driven Comparison for Investors

Income REITs offer attractive yields compared to bonds but come with different risk profiles; this data-driven comparison helps investors understand the nuances between investing in Income REITs versus Bonds.

For income-seeking investors, the choice between Income REITs vs. Bonds: A Data-Driven Comparison for Income Investors represents a crucial decision. Both offer the potential for steady income streams, but their risk profiles, tax implications, and growth potential differ significantly. Understanding these nuances is key to making informed investment choices.

Understanding Income REITs

Income REITs, or Real Estate Investment Trusts, are companies that own or finance income-producing real estate across a range of property sectors. They allow investors to earn a share of the income produced from real estate without directly owning the properties themselves.

These REITs can specialize in various types of real estate, offering investors diversification within the real estate market.

Types of Income REITs

Income REITs come in various forms, each with its unique investment focus. Here are a few common types:

- Equity REITs: Own and operate income-producing real estate, collecting rent from tenants.

- Mortgage REITs: Invest in mortgages and mortgage-backed securities, earning income from interest payments.

- Hybrid REITs: Combine both equity and mortgage investments, offering a blend of income streams.

Equity REITs are generally considered less volatile than mortgage REITs, as their income is derived from long-term lease agreements. However, they are still subject to market fluctuations and property-specific risks.

Exploring the World of Bonds

Bonds are essentially loans made by investors to a borrower, typically a corporation or government. In return for the loan, the borrower agrees to pay the investor a fixed interest rate over a specified period.

Bonds are often viewed as a safer investment than stocks, but their returns tend to be lower.

Types of Bonds

The bond market offers a wide array of options, each with varying levels of risk and return. Here are some common types:

- Government Bonds: Issued by national governments and are generally considered the safest type of bond.

- Corporate Bonds: Issued by corporations to raise capital and typically offer higher yields than government bonds but come with greater risk.

- Municipal Bonds: Issued by state and local governments and are often tax-exempt, making them attractive to high-income investors.

Different credit ratings reflect the risk associated with each bond type. AAA-rated bonds are considered the safest, while lower-rated bonds offer higher yields to compensate for the increased risk of default.

Yield Comparison: REITs vs. Bonds

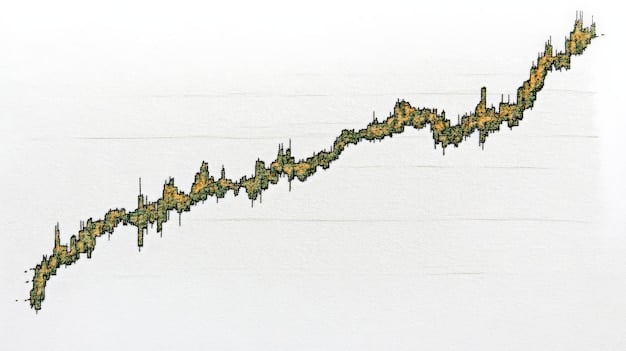

A key factor for income investors is the yield, or the annual income return on an investment. Historically, REITs have often offered higher yields than bonds, but this premium comes with added risk.

However, is this always the case or are there other parameters to consider?

Historical Yield Trends

Over the past decade, REITs have generally outperformed bonds in terms of yield. According to data from the National Association of Real Estate Investment Trusts (NAREIT), the average dividend yield for equity REITs has been higher than the yield on 10-year Treasury bonds.

- REIT yields have often hovered between 3% and 6%.

- Bond yields have varied based on economic conditions, sometimes falling below 2%.

- However, past performance is not indicative of future results, and yield spreads can change.

These trends reflect the different risk profiles of REITs and bonds. REITs, being tied to the real estate market, are more sensitive to economic fluctuations. Bonds, especially government bonds, are often seen as a safe haven during times of uncertainty, leading to lower yields.

Risk Factors: Assessing Potential Downsides

While REITs may offer higher yields, they also come with greater risk. Bonds, particularly government bonds, are generally considered safer due to their lower volatility and risk of default. However, they can still be affected by inflation and interest rate changes.

Understanding these risks is essential for making informed investment decisions.

Risks Associated with REITs

Investing in REITs exposes investors to several risks, including:

- Market Risk: REIT values can decline due to economic downturns, changes in interest rates, or negative sentiment towards the real estate market.

- Property-Specific Risk: Vacancy rates, tenant defaults, or unexpected maintenance costs can impact a REIT’s income and profitability.

- Interest Rate Risk: Rising interest rates can increase borrowing costs for REITs, reducing their profitability and potentially lowering dividend payouts.

However, diversification can help mitigate these risks. By investing in a basket of REITs across different property sectors and geographic locations, investors can reduce their exposure to any single property or market.

Tax Implications: Maximizing After-Tax Returns

The tax treatment of REIT dividends and bond interest can significantly impact an investor’s after-tax returns. REIT dividends are typically taxed as ordinary income, while bond interest may be subject to different tax rates depending on the type of bond.

Therefore, it’s important to consider the tax implications of each investment option.

Taxation of REIT Dividends

REIT dividends are generally taxed as ordinary income, which means they are subject to an investor’s marginal tax rate. However, some REIT dividends may qualify for the qualified dividend tax rate, which is lower than the ordinary income tax rate.

- REIT dividends are often higher than bond interest payments.

- But their tax treatment could reduce their after-tax appeal.

- Consulting with a tax advisor can help investors optimize their tax strategies.

In tax-advantaged accounts like 401(k)s or IRAs, the tax implications of REIT dividends are less of a concern, as these accounts offer either tax deferral or tax-free growth.

Making the Right Choice for Your Portfolio

The decision between income REITs and bonds ultimately depends on an investor’s individual circumstances, risk tolerance, and financial goals. There is no one-size-fits-all answer, as both investment options can play a valuable role in a well-diversified portfolio.

Let’s summarize, how to think about it?

Factors to Consider

Before making a decision, investors should carefully consider the following factors:

- Risk Tolerance: How comfortable are you with the volatility of REITs?

- Investment Goals: Are you seeking high income, capital appreciation, or a combination of both?

- Time Horizon: How long do you plan to hold the investment?

Ultimately, the best approach may be to allocate a portion of your portfolio to both REITs and bonds, striking a balance between income potential and risk management. Diversification is key to building a resilient and sustainable investment strategy.

| Key Point | Brief Description |

|---|---|

| 💰 Higher Yields | REITs often offer higher yields compared to bonds due to their direct involvement in real estate income. |

| 📉 Risk Factors | REITs involve market, property-specific, and interest rate risks, while bonds are generally safer but can be affected by inflation. |

| tax implications | REIT dividends are usually taxed as ordinary income, while bond interest can vary, affecting after-tax returns. |

| 🎯 Portfolio Fit | Deciding between REITs and bonds depends on risk tolerance, investment goals, and time horizon, with diversification being a key strategy. |

Frequently Asked Questions

▼

Income REITs invest in real estate, while bonds are loans to corporations or governments. REITs generally offer higher yields with more risk, and bonds are considered safer with lower returns.

▼

Generally, bonds are considered safer because they have lower volatility and risk of default. REITs are subject to market, property-specific, and interest rate risks.

▼

REIT dividends are typically taxed as ordinary income, although some may qualify for lower qualified dividend tax rates. This can impact your after-tax returns.

▼

Risks include market risk (economic downturns), property-specific risk (vacancy rates), and interest rate risk (rising borrowing costs), all of which can impact REIT profitability.

▼

Consider your risk tolerance, investment goals, and time horizon. A diversified portfolio that includes both REITs and bonds can balance income potential with risk management.

Conclusion

Ultimately, the choice between income REITs and bonds hinges on individual investment goals, risk tolerance, and a thorough understanding of each asset’s characteristics. By carefully weighing the pros and cons, investors can make informed decisions that align with their financial objectives and build a well-rounded income portfolio.