REIT Dividend Sustainability: Evaluating Payout Ratios & Cash Flow

REIT dividend sustainability hinges on evaluating payout ratios and cash flow, ensuring long-term dividend reliability for US Real Estate Investment Trusts by scrutinizing financial health and operational performance.

For investors seeking stable income, understanding REIT dividend sustainability: evaluating payout ratios and cash flow to determine long-term dividend reliability for US REITs is paramount. This article delves into the critical factors that ensure the longevity and reliability of REIT dividends.

Understanding REITs and Dividend Importance

Real Estate Investment Trusts (REITs) are companies that own or finance income-producing real estate across a range of property sectors. They are designed to provide investors with a regular income stream, often in the form of dividends. The appeal of REITs largely stems from their ability to generate consistent income, making dividend sustainability a key consideration for investors.

The reliability of these dividends is crucial. Investors depend on these payouts to meet their financial needs, especially in retirement. Therefore, understanding how to assess the long-term sustainability of REIT dividends is essential for making informed investment decisions.

The Basics of REITs

REITs operate under specific tax rules that require them to distribute a significant portion of their taxable income to shareholders as dividends. This structure provides both benefits and challenges to their dividend policies.

Understanding the operational structure of REITs is the first step in assessing their ability to maintain consistent dividend payments. Factors such as property type, geographic location, and tenant quality also play critical roles in a REIT’s overall stability.

- Tax Regulations: REITs must distribute at least 90% of their taxable income to shareholders to maintain their tax-advantaged status.

- Property Sectors: REITs can specialize in various property types, including office buildings, retail spaces, residential apartments, and healthcare facilities.

- Investment Strategies: Some REITs focus on growth, while others prioritize income, affecting their dividend payout policies.

In conclusion, understanding the fundamental aspects of REITs, including their tax structure and operational strategies, is pivotal for evaluating their dividend sustainability. This foundational knowledge sets the stage for a deeper dive into the financial metrics that drive dividend reliability.

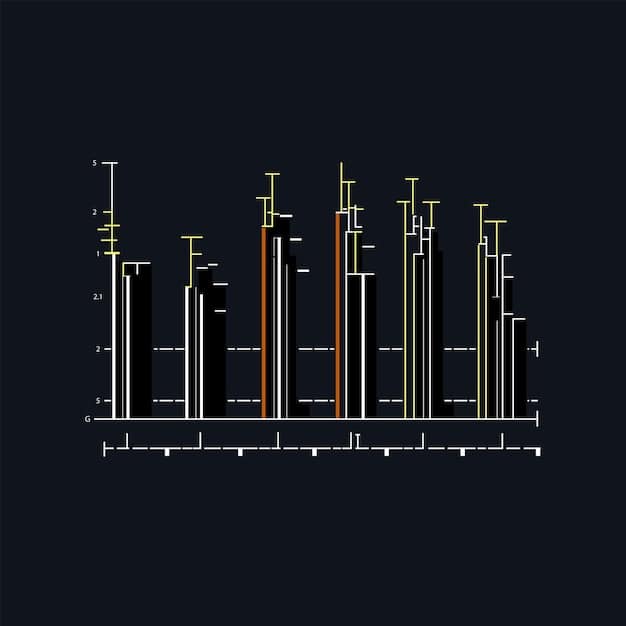

Payout Ratios: A Key Indicator

The payout ratio is a fundamental metric used to assess the sustainability of a REIT’s dividend. It indicates the proportion of a REIT’s earnings that are paid out as dividends. Analyzing this ratio can provide insights into whether a REIT can comfortably afford its current dividend payments and continue doing so in the future.

A high payout ratio may suggest that a REIT is distributing most of its earnings, leaving little room for reinvestment or to cover unexpected expenses. Conversely, a low payout ratio implies that the REIT has ample earnings to cover its dividends and potentially increase them in the future.

Understanding the Funds Available for Distribution (FAD) Payout Ratio

For REITs, the Funds Available for Distribution (FAD) payout ratio is particularly relevant. FAD is a measure of a REIT’s cash flow available for distribution to shareholders. It offers a more accurate picture of a REIT’s ability to pay dividends than net income alone.

The FAD payout ratio is calculated by dividing dividends paid by the FAD. A sustainable FAD payout ratio typically falls within a reasonable range, allowing the REIT to maintain its financial health while providing attractive dividends to investors.

- Calculation: FAD is calculated by adjusting net income for items such as depreciation, amortization, and gains or losses from property sales.

- Benchmarks: A FAD payout ratio below 80% is generally considered sustainable, although this can vary depending on the REIT’s specific circumstances.

- Considerations: Investors should compare a REIT’s FAD payout ratio to its peers and historical performance to gain a comprehensive understanding.

In summary, the FAD payout ratio is a crucial indicator of a REIT’s dividend sustainability. It provides a clear view of whether the REIT’s dividend payments are supported by its cash flow, ensuring that investors can rely on these payouts for the long term.

Cash Flow Analysis and Dividend Coverage

Analyzing a REIT’s cash flow is essential for determining its ability to sustain dividend payments. Cash flow provides a view of the actual money flowing into and out of the REIT, offering a more realistic assessment of its financial health compared to accounting earnings alone.

Strong and consistent cash flow is necessary to cover dividend obligations, fund property improvements, and pursue growth opportunities. Insufficient cash flow can lead to dividend cuts or a need to raise capital through debt or equity offerings, which can dilute shareholder value.

Key Cash Flow Metrics for REITs

Several key cash flow metrics are particularly useful for evaluating a REIT’s dividend sustainability. These metrics include Funds From Operations (FFO), Adjusted Funds From Operations (AFFO), and free cash flow.

Each of these metrics provides a different perspective on a REIT’s cash-generating ability. Understanding how to interpret these metrics can help investors assess whether a REIT has sufficient cash to maintain its dividend payments.

- FFO: Funds From Operations is a widely used measure that adds depreciation and amortization back to net income and removes gains or losses from property sales. It reflects the cash flow generated from a REIT’s core operations.

- AFFO: Adjusted Funds From Operations further refines FFO by deducting capital expenditures and other non-cash items. It provides a more accurate picture of the cash available for distribution to shareholders.

- Free Cash Flow: Free cash flow is the cash a REIT has left after covering its operating expenses and capital expenditures. It represents the true discretionary cash flow available for dividends, debt repayment, and other uses.

In conclusion, a comprehensive cash flow analysis is vital for evaluating the dividend sustainability of a REIT. By examining key cash flow metrics like FFO, AFFO, and free cash flow, investors can gain a deeper understanding of a REIT’s ability to maintain reliable dividend payments.

Debt Levels and Financial Leverage

A REIT’s debt levels and financial leverage play a significant role in its dividend sustainability. High levels of debt can strain a REIT’s cash flow, making it more difficult to maintain consistent dividend payments. Prudent management of debt is crucial for ensuring long-term financial stability and dividend reliability.

Excessive debt can increase a REIT’s vulnerability to economic downturns and rising interest rates. Conversely, conservative leverage can provide financial flexibility and support dividend growth.

Analyzing Debt Metrics

Several debt metrics can help investors assess a REIT’s financial leverage. These include debt-to-asset ratio, debt-to-equity ratio, and interest coverage ratio. Analyzing these metrics can provide insights into a REIT’s ability to manage its debt obligations.

Understanding these debt metrics is crucial for evaluating the risk associated with a REIT’s dividend. A high debt-to-asset ratio, for example, may indicate that the REIT is highly leveraged and could face challenges in maintaining its dividend payments.

- Debt-to-Asset Ratio: This ratio measures the proportion of a REIT’s assets that are financed by debt. A lower ratio indicates less leverage.

- Debt-to-Equity Ratio: This ratio compares a REIT’s total debt to its shareholder equity. It indicates the extent to which a REIT is using debt to finance its operations.

- Interest Coverage Ratio: This ratio measures a REIT’s ability to cover its interest expenses with its earnings. A higher ratio indicates a greater capacity to service debt.

In summary, a thorough analysis of a REIT’s debt levels and financial leverage is essential for assessing its dividend sustainability. By examining key debt metrics, investors can gain a clearer understanding of the potential risks and rewards associated with a REIT’s dividend payments.

Management Quality and Governance

The quality of a REIT’s management and its corporate governance practices are critical factors in determining dividend sustainability. Competent and ethical management teams are more likely to make sound financial decisions that support long-term dividend reliability.

Strong corporate governance practices ensure that a REIT operates in the best interests of its shareholders, reducing the risk of mismanagement and financial irregularities. Investors should carefully evaluate the management team’s track record and the REIT’s governance structure.

Assessing Management and Governance

Several factors can help investors assess the quality of a REIT’s management and its governance practices. These include the management team’s experience, the REIT’s board composition, and its commitment to transparency and ethical conduct.

Evaluating these factors can provide insights into whether a REIT is well-managed and committed to protecting shareholder interests. A strong management team and robust governance practices can enhance the likelihood of sustainable dividend payments.

- Management Experience: Look for management teams with a proven track record in the real estate industry.

- Board Composition: Ensure that the REIT’s board includes independent directors who can provide objective oversight.

- Transparency: Evaluate the REIT’s commitment to transparency in its financial reporting and investor communications.

In conclusion, the quality of a REIT’s management and its corporate governance practices are vital determinants of dividend sustainability. By carefully assessing these factors, investors can gain confidence in a REIT’s ability to maintain reliable dividend payments over the long term.

External Factors: Economic Conditions and Interest Rates

External factors, such as economic conditions and interest rates, can significantly impact a REIT’s dividend sustainability. Economic downturns can reduce occupancy rates and rental income, while rising interest rates can increase borrowing costs and strain cash flow.

Understanding how these external factors can affect a REIT’s financial performance is crucial for assessing its dividend reliability. REITs that are well-positioned to weather economic challenges and interest rate fluctuations are more likely to maintain consistent dividend payments.

Impact of Economic Conditions

Economic conditions can influence a REIT’s dividend sustainability in several ways. During economic downturns, demand for real estate may decline, leading to lower occupancy rates and reduced rental income. This can put pressure on a REIT’s cash flow and its ability to pay dividends.

Conversely, during economic expansions, demand for real estate may increase, leading to higher occupancy rates and increased rental income. This can create opportunities for REITs to increase their dividend payments.

- Occupancy Rates: Monitor occupancy rates in the REIT’s property sectors. Declining occupancy rates can indicate weakening demand.

- Rental Income: Track rental income trends. Declining rental income can signal financial challenges.

- Economic Forecasts: Stay informed about economic forecasts and their potential impact on the real estate market.

Impact of Interest Rates

Interest rates can also significantly affect a REIT’s dividend sustainability. Rising interest rates can increase a REIT’s borrowing costs, reducing its cash flow and its ability to pay dividends. REITs with high levels of debt are particularly vulnerable to rising interest rates.

Conversely, falling interest rates can reduce a REIT’s borrowing costs, increasing its cash flow and its ability to pay dividends. REITs with conservative leverage can benefit from lower interest rates.

In summary, external factors such as economic conditions and interest rates play a crucial role in determining a REIT’s dividend sustainability. By understanding these factors and their potential impact, investors can make more informed decisions about investing in REITs.

| Key Metric | Brief Description |

|---|---|

| 💰 Payout Ratio | Percentage of earnings paid as dividends; lower is generally more sustainable. |

| 💸 Cash Flow | FFO and AFFO indicate the REIT’s ability to cover dividend obligations. |

| 📊 Debt Levels | Debt-to-asset and interest coverage ratios indicate financial health. |

| 🏢 Economic Factors | Economic conditions and interest rates impact dividend sustainability. |

[Frequently Asked Questions]

▼

A FAD payout ratio below 80% is generally considered sustainable, allowing the REIT to reinvest and cover unexpected expenses. However, this can vary by REIT based on unique circumstances.

▼

Rising interest rates can increase borrowing costs for REITs, reducing cash flow available for dividends. REITs with high debt levels are more vulnerable to this.

▼

Cash flow analysis shows the actual money a REIT generates, reflecting its ability to cover dividends and fund operations, surpassing net income’s view on earnings.

▼

Effective management ensures sound financial decisions, prudent debt management, and transparent governance, all essential for maintaining stable dividend payments.

▼

FFO means Funds From Operations.It adds depreciation and amortization back to net income and removes gains or losses from property sales, This reflects core operations.

Conclusion

In conclusion, evaluating REIT dividend sustainability: evaluating payout ratios and cash flow to determine long-term dividend reliability for US REITs requires a comprehensive analysis of payout ratios, cash flow, debt levels, management quality, and external economic factors. By carefully examining these factors, investors can make informed decisions about investing in REITs and ensure they receive a reliable stream of income.