Income REIT Dividends: Evaluating Sustainability Beyond a 7% Yield

Evaluating the sustainability of income REIT dividends, especially those exceeding a 7% yield, involves analyzing various financial health indicators such as FFO payout ratio, debt levels, property portfolio quality, and macroeconomic trends.

High dividend yields from Income REITs can be attractive, but it’s crucial to assess whether these payouts are sustainable. To help investors navigate this landscape, this article will explore how to evaluate the long-term viability of Income REIT dividends, especially when they exceed 7%, ensuring you make informed investment decisions.

Understanding Income REITs and Dividend Appeal

Income REITs (Real Estate Investment Trusts) are companies that own or finance income-producing real estate across a range of property sectors. They’re designed to provide investors with regular income streams through dividends. The appeal of Income REITs lies in their structure, which requires them to distribute a significant portion of their taxable income to shareholders, often resulting in attractive dividend yields.

For investors seeking income, REITs can be a compelling option. However, a high dividend yield alone shouldn’t be the sole factor in making investment decisions. It’s essential to dive deeper and analyze the sustainability of those yields, as a high yield can sometimes indicate underlying financial issues.

Key Characteristics of Income REITs

Income REITs have some specific characteristics that set them apart from other investments. These include:

- Mandatory Payouts: REITs are legally required to distribute a large percentage of their taxable income as dividends, making them attractive to income-seeking investors.

- Diverse Property Portfolios: Income REITs invest in various types of properties, from residential and commercial to industrial and specialized real estate, providing diversification within the real estate sector.

- Transparent Financial Reporting: REITs are required to provide detailed financial reports, allowing investors to scrutinize their performance metrics.

Understanding these characteristics is the first step in evaluating the sustainability of an Income REIT’s dividend yield. High yields are great, but not if the REIT is taking on more debt or selling assets. This article focuses on how to assess the long-term dividend sustainability.

Analyzing the Funds From Operations (FFO) Payout Ratio

The Funds From Operations (FFO) payout ratio is a critical metric to evaluate the sustainability of an Income REIT’s dividend. FFO represents the cash flow generated from the REIT’s operations and is a more accurate measure of profitability than net income. The payout ratio indicates the percentage of FFO that is being paid out as dividends.

A high payout ratio can signal that the REIT is distributing a large portion of its earnings, leaving less capital for reinvestment or debt reduction. While a low payout ratio suggests the dividend is well-covered, it might also mean the REIT is not maximizing its income distribution potential.

Calculating and Interpreting the FFO Payout Ratio

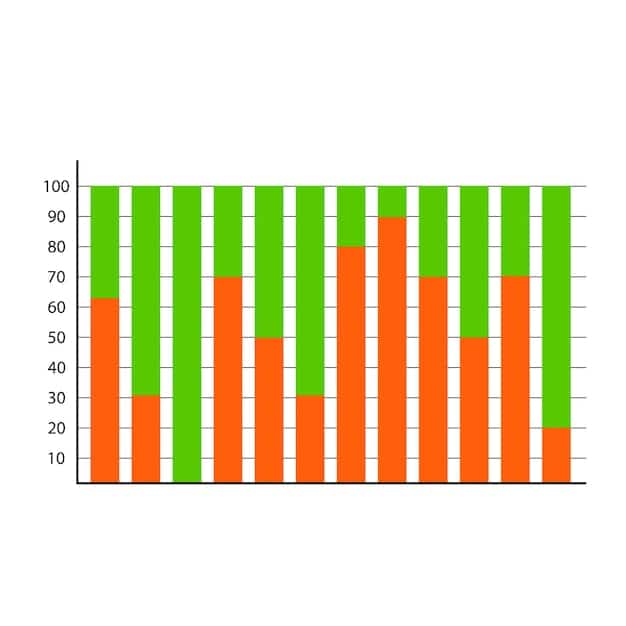

The FFO payout ratio is calculated by dividing the total dividends paid by the Funds From Operations (FFO). Here’s how to interpret the results:

- Sustainable Range (60-80%): A payout ratio within this range typically indicates a sustainable dividend, allowing the REIT to reinvest in its properties and manage its debt effectively.

- High-Risk Range (Above 80%): Ratios above 80% may signal a high risk of dividend cuts, especially if the REIT faces financial challenges or market downturns.

- Conservative Range (Below 60%): While conservative, a payout ratio below 60% might mean the REIT is retaining too much capital, which could be distributed to shareholders.

Analyzing the FFO payout ratio trends over several years can provide a more accurate picture of the REIT’s ability to sustain its dividend. Consistent high payout ratios should raise red flags, prompting further investigation.

Assessing Debt Levels and Financial Leverage

Debt levels and financial leverage are crucial factors to consider when evaluating the sustainability of an Income REIT’s dividend. A REIT with high debt may struggle to maintain its dividend payouts, especially during economic downturns or periods of rising interest rates. Understanding how a REIT manages its debt is vital for assessing its long-term financial health.

Excessive debt can lead to increased financial risk and potential dividend cuts. Investors should look for REITs that maintain a balance between debt and equity, demonstrating responsible financial management.

- Debt-to-Equity Ratio: Compares a company’s total debt to its shareholder equity. A high ratio indicates higher risk.

- Interest Coverage Ratio: Measures a company’s ability to pay interest on its outstanding debt. Look for ratios above 2.5x.

- Net Debt to EBITDA: Assesses a company’s ability to pay back its debt. A ratio below 5x is generally considered healthy.

Evaluating several financial leverage metrics will help to better understand a company’s financial safety and its dividend prospective.

Evaluating the Quality and Diversification of the Property Portfolio

The quality and diversification of a REIT’s property portfolio are critical determinants of its long-term financial health and dividend sustainability. A diversified portfolio can mitigate risks associated with economic downturns, while high-quality properties can maintain stable income streams.

Property portfolio diversification refers to the variety of property types and geographic locations within a REIT’s holdings. A well-diversified portfolio reduces the risk of significant income loss from a single property or market.

Key Metrics for Evaluating Property Portfolio

Here are some key factors to consider when evaluating the strength and diversification of a REIT’s property portfolio:

- Occupancy Rate: High occupancy rates indicate strong demand for the REIT’s properties and stable rental income. Look for rates above 90%.

- Lease Terms: Longer lease terms provide more predictable income streams, reducing the risk of vacancies and income fluctuations.

- Property Type: Diversification across different property types (e.g., residential, commercial, industrial) can buffer the REIT against sector-specific risks.

Case studies of diversified and non-diversified REITs

Let’s look briefly at examples of REITs with poor and great diversification.

- Great: A large REIT having properties in many markets with diversified property types.

- Poor: A smaller REIT with properties concentrated only in one or two property types.

The quality of a REIT’s property portfolio directly impacts its ability to generate sustainable dividend income.

Analyzing Macroeconomic Factors and Interest Rate Sensitivity

Macroeconomic factors and interest rate sensitivity play a significant role in the sustainability of Income REIT dividends. Economic conditions can impact property values, rental income, and occupancy rates, while changes in interest rates can affect a REIT’s borrowing costs and profitability.

Investors should monitor key economic indicators such as GDP growth, inflation, and unemployment rates to assess the overall health of the real estate market and its potential impact on REIT performance.

Impact of Macroeconomic Trends on REIT Performance

Economic recessions, expansions, and other periods greatly affect REIT performance. A few items to monitor include:

- Interest Rate Hikes: Rising interest rates can increase borrowing costs for REITs, reducing their profitability and potentially impacting dividend payouts.

- Inflation: REITs may increase rent based on the rate of inflation.

- Employment Rate: Strong job growth can lead to increased demand for commercial and residential properties, boosting rental income and property values.

Analyzing macroeconomic trends and interest rate sensitivity can help investors gauge the sustainability of Income REIT dividends and make more informed investment decisions.

Implementing Due Diligence and Monitoring Your Investment

Effective due diligence and ongoing monitoring are essential for ensuring the sustainability of your Income REIT investments. Review of all documents and continued monitoring are crucial investments.

Before investing in an Income REIT, conduct thorough research on the company’s financials, property portfolio, and management team. Utilize resources such as annual reports, investor presentations, and independent research reports to gather comprehensive information.

Steps for Effective Due Diligence and Monitoring

A few steps for effective due diligence:

- Review Financial Statements: Analyze the REIT’s balance sheet, income statement, and cash flow statement to assess its financial health and profitability.

- Follow Industry News and Analysis: Stay informed about industry trends, regulatory changes, and company-specific developments that could impact the REIT’s performance and sustainability.

- Assess Management Quality: Evaluate the experience and track record of the REIT’s management team, as their decisions can significantly influence the company’s success.

By implementing diligent due diligence and monitoring practices, investors can make more informed decisions and mitigate the risks associated with Income REIT investments.

| Key Metrics | Brief Description |

|---|---|

| 💰 FFO Payout Ratio | Percentage of Funds From Operations paid as dividends, ideally 60-80%. |

| 📈 Debt Levels | Assessing debt-to-equity, interest coverage, and net debt to EBITDA ratios. |

| 🏢 Portfolio Quality | Analyzing occupancy rates, lease terms, and property type diversification. |

| 🌍 Macro Factors | Monitoring GDP growth, interest rates, and unemployment for impacts. |

Frequently Asked Questions

▼

FFO (Funds From Operations) is a key metric for REITs. It adjusts net income to better reflect cash flow by adding back depreciation and amortization, providing a more accurate view of a REIT’s operating performance.

▼

High debt levels can strain a REIT’s finances, especially with rising interest rates. This can reduce the funds available for dividend payouts, making high-yield dividends unsustainable if debt isn’t managed well.

▼

Diversification across property types and locations reduces the risk of income loss from regional economic downturns or sector-specific challenges. A varied portfolio provides more stable cash flow.

▼

Rising interest rates increase borrowing costs for REITs, potentially reducing profitability and dividend payouts. REITs with variable-rate debt are particularly vulnerable to interest rate hikes.

▼

A sustainable FFO payout ratio is generally between 60% and 80%. This range indicates that the REIT is distributing a reasonable portion of its earnings while retaining enough capital for reinvestment and debt management.

Conclusion

Evaluating the sustainability of Income REIT Dividends: How to Evaluate Sustainability Beyond a 7% Yield requires a comprehensive analysis of financial metrics, property portfolio characteristics, and macroeconomic factors. By understanding these aspects and conducting thorough due diligence, investors can make informed decisions and navigate the complexities of Income REIT investments to secure sustainable income streams.