REITs vs. Bonds: Which is Best for Income Investors?

REITs and bonds are both popular investment options for income-seeking investors, but they have significant differences in risk, return, and investment characteristics that must be considered.

For investors seeking steady income streams, understanding the nuances between REITs vs. bonds: a head-to-head comparison for income-seeking investors is crucial. Both offer potential benefits, but cater to different risk appetites and investment goals.

Understanding REITs: An Overview for Investors

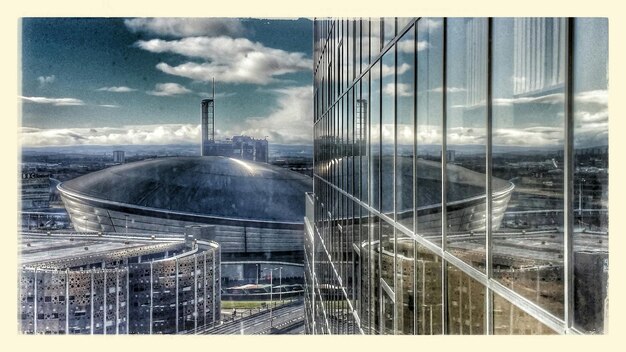

Real Estate Investment Trusts (REITs) offer a unique way to invest in real estate without directly owning properties. They provide income through dividends generated from rental income and property appreciation.

Understanding REITs involves recognizing their structure, benefits, and risks. They can be a valuable addition to a diversified portfolio, offering exposure to a different asset class.

Types of REITs

There are several types of REITs, each focusing on different property sectors. Understanding these types is crucial for targeted investment strategies.

- Equity REITs: Own and operate income-producing real estate properties.

- Mortgage REITs (mREITs): Invest in mortgages and mortgage-backed securities.

- Hybrid REITs: Combine both equity and mortgage investments.

Advantages of Investing in REITs

REITs offer several advantages, including high dividend yields and diversification benefits.

- High Dividend Yields: REITs are required to distribute a significant portion of their taxable income to shareholders, resulting in attractive dividend payouts.

- Diversification: REITs provide exposure to the real estate market, which can help diversify a portfolio.

- Liquidity: Publicly traded REITs are easily bought and sold on stock exchanges.

Investing in REITs can provide a steady income stream and portfolio diversification. However, it is essential to consider the risks associated with the real estate market and interest rate fluctuations.

Exploring Bonds: A Fixed-Income Perspective

Bonds are a type of fixed-income investment that represents a loan made by an investor to a borrower (typically a corporation or government). Bonds offer a predetermined interest rate and return the principal amount at maturity.

Bonds are often considered a safer investment than stocks, providing a stable income stream. However, their returns may be lower compared to other asset classes.

Types of Bonds

Various types of bonds cater to different investment preferences and risk profiles. Understanding these types is essential for building a well-rounded fixed-income portfolio.

- Government Bonds: Issued by national governments, considered low-risk investments.

- Corporate Bonds: Issued by corporations, offering higher yields but also higher risk.

- Municipal Bonds: Issued by state and local governments, often tax-exempt.

Benefits of Investing in Bonds

Bonds offer stability, income, and capital preservation, making them a core component of many investment portfolios.

- Fixed Income: Bonds provide a predictable stream of income through regular interest payments.

- Capital Preservation: Bonds are generally less volatile than stocks, offering greater capital preservation.

- Diversification: Bonds can help diversify a portfolio, reducing overall risk.

Investing in bonds can provide a steady income stream and portfolio stability. However, it is crucial to consider the impact of inflation and interest rate changes on bond values.

Risk and Return: REITs vs. Bonds

Risk and return are fundamental considerations when choosing between REITs and bonds. Each investment offers a unique risk-return profile that suits different investor preferences and goals.

Understanding the risk-return dynamics of REITs and bonds is essential for making informed investment decisions. While REITs offer potentially higher returns, they also come with greater volatility.

Risk Factors in REITs

REITs are subject to various risk factors, including market volatility, interest rate fluctuations, and property-specific risks. Understanding these risks is crucial for managing investment exposure.

- Market Volatility: REIT prices can fluctuate based on market sentiment and economic conditions.

- Interest Rate Risk: Rising interest rates can negatively impact REIT values and dividend yields.

- Property-Specific Risks: Vacancy rates, property maintenance, and local market conditions can affect REIT performance.

Risk Factors in Bonds

Bonds are subject to several risk factors, including inflation risk, interest rate risk, and credit risk. Assessing these risks is vital for preserving capital and generating stable returns.

- Inflation Risk: Rising inflation can erode the real value of bond yields.

- Interest Rate Risk: Rising interest rates can decrease the value of existing bonds.

- Credit Risk: The risk that the bond issuer may default on its payment obligations.

Comparing the risk profiles of REITs and bonds enables investors to make informed decisions based on their individual risk tolerance and investment objectives. Both investments offer potential benefits but require careful risk assessment.

Yield Comparison: REITs versus Bonds

Yield is a crucial factor for income-seeking investors comparing REITs and bonds. Understanding the yield dynamics of each investment is essential for maximizing returns and achieving financial goals.

While REITs often offer higher dividend yields than bonds, it’s crucial to consider the sustainability and risk associated with those yields.

Factors Affecting REIT Yields

Several factors can affect REIT yields, including property performance, dividend payout policies, and market conditions. Monitoring these factors is essential for understanding yield fluctuations.

REIT yields are influenced by:

- Occupancy rates: Higher occupancy rates typically lead to higher rental income and dividend yields.

- Rental income: Changes in rental rates can impact REIT revenues and dividend payouts.

- Interest rates: Rising interest rates can put downward pressure on REIT yields.

Factors Affecting Bond Yields

Bond yields are influenced by various factors, including interest rate policies, credit ratings, and economic conditions. Keeping track of these factors is vital for assessing bond investment opportunities.

Key influencers for bond yields include:

- Interest rate policies: Central bank decisions on interest rates can significantly impact bond yields.

- Credit ratings: Higher credit ratings typically result in lower bond yields due to lower risk.

- Economic conditions: Inflation, economic growth, and unemployment rates can affect bond yields.

Comparing the yield dynamics of REITs and bonds helps investors make informed decisions based on their income requirements and risk preferences. While REITs can offer higher potential yields, bonds provide more stability and capital preservation.

Tax Implications: REITs and Bonds

Tax implications are an important consideration for investors choosing between REITs and bonds. Understanding the tax treatment of each investment can significantly impact after-tax returns and overall financial outcomes.

REIT distributions are often taxed differently than bond interest, which can affect an investor’s overall tax liability.

Taxation of REIT Dividends

REIT dividends are typically taxed as ordinary income, which can be at a higher rate than qualified dividends or capital gains. Understanding these tax implications is crucial for tax planning.

Important considerations for REIT dividends include:

- Ordinary income: REIT dividends are generally taxed at the investor’s ordinary income tax rate.

- Qualified dividends: A portion of REIT dividends may qualify for lower tax rates.

- Return of capital: Some REIT distributions may be considered a return of capital, which is not immediately taxable.

Taxation of Bond Interest

Bond interest is typically taxed as ordinary income, similar to REIT dividends. However, tax-exempt municipal bonds offer tax advantages for investors in high-tax brackets.

Key aspects of bond interest taxation include:

- Ordinary income: Bond interest is generally taxed at the investor’s ordinary income tax rate.

- Municipal bonds: Interest from municipal bonds is often exempt from federal and state taxes.

- Treasury securities: Interest from Treasury securities is exempt from state and local taxes.

Comparing the tax implications of REITs and bonds enables investors to make tax-efficient investment decisions. Understanding the tax treatment of each investment can help optimize after-tax returns and financial outcomes.

Portfolio Allocation: Combining REITs and Bonds

Portfolio allocation is a critical aspect of investment strategy, particularly when considering REITs and bonds. Combining these assets can create a balanced portfolio that optimizes risk-adjusted returns.

A well-diversified portfolio that includes both REITs and bonds can provide a blend of income, growth, and stability.

Strategic Allocation to REITs

Strategic allocation to REITs involves determining the appropriate percentage of a portfolio to allocate to real estate investments. This decision depends on the investor’s risk tolerance, investment goals, and market outlook.

Factors influencing REIT allocation include:

- Risk tolerance: Investors with higher risk tolerance may allocate a larger portion of their portfolio to REITs.

- Investment goals: Income-seeking investors may allocate a significant portion of their portfolio to REITs for dividend income.

- Market outlook: Bullish real estate market conditions may warrant a higher allocation to REITs.

Strategic Allocation to Bonds

Strategic allocation to bonds involves determining the appropriate percentage of a portfolio to allocate to fixed-income investments. This decision depends on the investor’s risk aversion, income needs, and economic outlook.

Key drivers for bond allocation are:

- Risk aversion: Investors with high risk aversion may allocate a larger portion of their portfolio to bonds for capital preservation.

- Income needs: Investors requiring a steady income stream may allocate a significant portion of their portfolio to bonds.

- Economic outlook: Bearish economic conditions may warrant a higher allocation to bonds for stability.

Combining REITs and bonds in a well-balanced portfolio can help investors achieve their financial goals while managing risk effectively. Strategic allocation to each asset class depends on individual circumstances and market conditions.

| Key Aspect | Brief Description |

|---|---|

| 🏢 REITs | Invest in real estate, offering dividends and potential capital appreciation. |

| 🛡️ Bonds | Fixed-income investments providing steady interest payments and capital preservation. |

| ⚠️ Risk | REITs are riskier due to market volatility; bonds are safer with lower returns. |

| 📊 Portfolio | Combining REITs and bonds balances risk and return in a diversified portfolio. |

Frequently Asked Questions

▼

REITs invest in real estate, offering potential for higher returns but also greater risk. Bonds are fixed-income investments, providing lower risk and stable income through interest payments.

▼

REITs typically offer higher dividend yields than bonds, making them attractive for income-seeking investors. However, bond income is generally more stable and predictable over time.

▼

REIT dividends are usually taxed as ordinary income, whereas some bond interest may be tax-exempt. This distinction can influence the after-tax return for investors.

▼

REITs offer diversification by providing exposure to the real estate market, while bonds serve as a stabilizing component, reducing overall portfolio risk. Combining both enhances portfolio resilience.

▼

REITs are subject to real estate market volatility, interest rate risk, and property-specific issues. Bonds are susceptible to inflation risk, interest rate risk, and potential issuer default.

Conclusion

In conclusion, both REITs and bonds offer distinct advantages for income-seeking investors. REITs provide the potential for higher returns through real estate investments, while bonds offer stability and capital preservation. The ideal choice depends on individual risk tolerance, investment goals, and tax considerations. A well-diversified portfolio may include both REITs and bonds to achieve a balanced approach to income generation and risk management.