REIT Expense Ratios: Are You Overpaying for Investment Management?

REIT expense ratios represent the annual costs of managing a Real Estate Investment Trust, encompassing management fees, operating expenses, and other charges, and understanding them is crucial for investors to assess whether the returns justify the management costs.

Are you invested in Real Estate Investment Trusts (REITs)? Understanding REIT expense ratios is crucial to ensure you’re not overpaying for the management of your investments. These ratios can significantly impact your returns, so let’s dive into what they are and how to assess them.

Understanding REIT Expense Ratios

REITs, or Real Estate Investment Trusts, offer investors a way to participate in the real estate market without directly owning properties. However, managing these investments comes with costs, reflected in the expense ratio. Let’s break down what this ratio entails.

What Does an Expense Ratio Include?

An expense ratio is the percentage of fund assets used to pay for operating expenses and management fees. For REITs, this typically includes:

- Management fees: Compensation to the REIT’s management team for overseeing the portfolio.

- Operating Expenses: Costs related to property maintenance, insurance, and administrative tasks.

- Other Fees: Legal, accounting, and other professional service fees.

It’s important to know exactly what is factored into your REIT’s expense ratio to make informed decisions.

Why REIT Expense Ratios Matter

Expense ratios directly influence the net return an investor receives from a REIT. Higher expense ratios eat into potential profits, while lower ratios leave more money in your pocket. Understanding why this matters can help you stay on track towards your investment goals.

Impact on Investment Returns

Consider two REITs with similar performance: one with a 1% expense ratio and another with a 2% expense ratio. The REIT with the lower expense ratio will yield higher returns, assuming all other factors are constant. This is due to the lower costs associated with managing the investment.

The Cumulative Effect Over Time

The impact of expense ratios compounds over time. A seemingly small difference can result in substantial savings in the long run. Therefore, keeping an eye on these fees is crucial for optimizing investment outcomes.

Expense ratios aren’t just numbers, but rather critical factors influencing the profitability of your REIT investments.

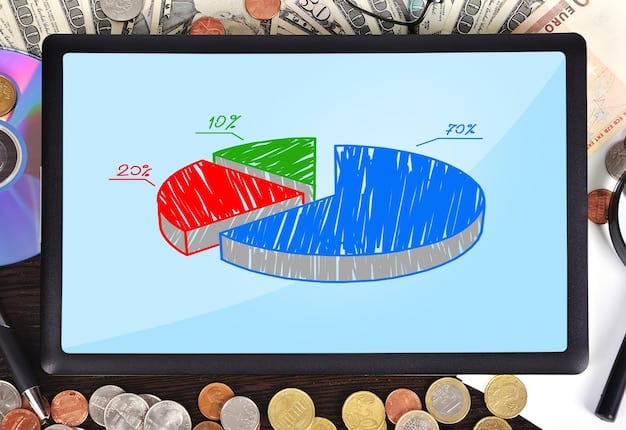

Typical REIT Expense Ratio Ranges

REIT expense ratios can vary depending on the type of REIT and its management structure. Knowing the typical range can help you quickly identify whether you are being charged a fair rate, compared to any other REIT. Let’s explore the differences.

- Equity REITs: These REITs own and manage income-producing real estate properties. Their expense ratios typically range from 1% to 2%.

- Mortgage REITs: These REITs invest in mortgages and mortgage-backed securities. Their expense ratios can be higher, ranging from 1.5% to 2.5%.

- Hybrid REITs: These REITs combine both equity and mortgage investments. Their expense ratios usually fall somewhere in between, around 1.25% to 2.25%.

Factors Influencing Expense Ratios

Besides the REIT type, several factors can influence expense ratios, including the size of the REIT, its investment strategy, and management efficiency.

Benchmarking Against Industry Averages

To assess whether a REIT’s expense ratio is reasonable, compare it against industry averages for similar REITs. This will provide a benchmark for evaluating the REIT’s cost-effectiveness.

Understanding typical expense ratios helps investors determine if their REIT fees are within an acceptable range.

Evaluating High Expense Ratios

If a REIT has a high expense ratio, it’s essential to investigate the reasons behind it. Sometimes, higher costs are justified by superior performance or specialized investment strategies. Let’s uncover possible reasons.

Reasons for Higher Costs

Higher expense ratios may be due to:

- Active Management: REITs that actively trade properties or mortgages may incur higher transaction costs.

- Complex Strategies: REITs pursuing niche or complex investment strategies may require more specialized expertise.

- Smaller Size: Smaller REITs may have higher overhead costs relative to their assets under management.

Weighing Costs Against Performance

Evaluate whether the REIT’s performance justifies the higher expense ratio. If the REIT consistently outperforms its peers, the increased costs may be acceptable.

Seeking Professional Advice

Consult a financial advisor to help assess whether the REIT’s expense ratio is reasonable in light of its investment objectives and risk tolerance.

Thorough evaluation of performance is critical to justifying higher REIT costs.

Strategies to Minimize Your Costs

Investors can take steps to minimize the impact of REIT expense ratios on their portfolios. Diversifying investments and opting for passively managed REITs are two effective methods. Let’s look at how you can reduce your costs.

Investing in Lower-Cost REITs

Explore lower-cost REIT options, such as index-tracking REIT ETFs, which typically have lower expense ratios than actively managed REITs.

Index Funds and ETFs

Index funds and ETFs offer a cost-effective way to gain exposure to the REIT market. These investments often have lower expense ratios than actively managed funds.

Negotiating Lower Fees

For larger investments, consider negotiating lower management fees with the REIT. Some REITs may be willing to offer discounts for significant investments.

Reducing fees gives you a better opportunity to enhance your ROI on investments.

REIT Expense Ratios: Due Diligence

Before investing in any REIT, conducting thorough due diligence is vital. Reviewing the REIT’s prospectus and financial statements will provide valuable insights into its expense ratio and management practices. Making sure that they have the proper experience and expertise can help you feel more confident.

Reviewing the REIT’s Prospectus

The prospectus contains detailed information about the REIT’s investment objectives, strategies, and fees. Pay especially close attention to the expense ratio and how it is calculated.

Analyzing Financial Statements

Financial statements reveal the REIT’s actual operating expenses and management fees. Compare these figures to previous years and to industry averages to identify any anomalies.

Understanding Management Performance

Evaluate the REIT’s management team and their track record. Look for experienced professionals with a history of delivering strong returns.

Due diligence ensures that you fully understand the cost structure and management quality of REIT investments.

## Real-World Examples of REIT Expense Ratios

Examining real-world examples can provide additional insight into how REIT expense ratios affect investment performance. Let’s look at different REIT options and how they may play a role in your investment portfolio.

Case Study 1: Low-Cost REIT ETF

Consider a low-cost REIT ETF with an expense ratio of 0.5%. Over 10 years, an initial investment of $10,000 could yield significantly higher returns compared to a higher-cost option.

Case Study 2: Actively Managed REIT

An actively managed REIT with an expense ratio of 1.5% aims to outperform its peers. However, its higher costs may offset any potential gains, especially during periods of market volatility.

Case Study 3: Mortgage REIT

A mortgage REIT with an expense ratio of 2.0% invests in mortgage-backed securities. Evaluate whether its higher yields justify the additional costs, considering the associated risks.

| Key Aspect | Brief Description |

|---|---|

| 💰 Evaluating Expense Ratios | Analyze expense ratios against performance to ensure value. |

| 📊 Types of REITs | Understand different REIT types (Equity, Mortgage, Hybrid) and their typical expense ranges. |

| 🔎 Due Diligence | Review prospectuses and financial statements for deep insights. |

| 📉 Minimizing Costs | Consider lower-cost REITs, ETFs, and negotiate fees for better returns. |

Frequently Asked Questions About REIT Expense Ratios

▼

A REIT expense ratio is the percentage of a REIT’s assets that are used to cover operating expenses and management fees. It’s an annual measurement of the total costs of managing the fund.

▼

You can typically find the expense ratio in the REIT’s prospectus or annual report. It’s usually listed under the “Fees and Expenses” section. Financial websites also provide this data.

▼

Generally, yes, a lower expense ratio is preferable. However, it should be balanced with the REIT’s performance and the expertise of its management. Ensure the lower cost doesn’t sacrifice quality.

▼

High expense ratios can be a red flag, but not always. Investigate the reasons behind the higher costs. It could be from active trading, complex strategies or the REIT being smaller in size.

▼

Consider investing in lower-cost REITs, index funds, or ETFs that track the REIT market. It can also be beneficial to negotiate lower fees if you have a substantial amount invested.

Conclusion

Understanding REIT expense ratios is crucial for optimizing investment outcomes. By evaluating these ratios and implementing cost-saving strategies, investors can enhance their returns and achieve their financial goals in the real estate market with more confidence.